BlackRock VP Compensation: A Multifaceted Analysis

Determining the precise salary of a BlackRock Vice President (VP) requires a nuanced approach, moving beyond simplistic averages found on platforms like Glassdoor. This analysis delves into the complexities of BlackRock's compensation structure, considering various factors and data sources to provide a more comprehensive understanding. The inherent variability in VP compensation underscores the importance of a multi-faceted approach to salary research. What seemingly straightforward question—how much does a BlackRock VP make?—reveals a complex, multivariable equation.

Understanding the Data Landscape: Glassdoor and Beyond

Glassdoor, a popular resource for salary information, provides initial estimates of BlackRock VP salaries, frequently ranging between $178,000 and $251,000 annually. However, relying solely on Glassdoor presents significant limitations. Its data is self-reported, meaning the sample size might be small, not wholly representative of BlackRock's diverse VP population, and subject to reporting biases. Furthermore, the data may not adequately reflect variations based on department, experience level, or performance. To gain a more accurate understanding, we must explore alternative data sources.

How can we move beyond these limitations inherent in self-reporting data sources? Using broader data sets is key.

Expanding the Data Horizon: Alternative Sources and Methodologies

To achieve a more accurate representation of BlackRock VP compensation, we must incorporate alternative data sources and methodologies. These include:

- Compensation Surveys: Reputable compensation survey firms, such as Willis Towers Watson and Mercer, collect data from numerous financial institutions, providing more robust benchmarks and industry-standard analyses.

- Competitor Analysis: Examining salary ranges for comparable VP roles at competing financial firms (e.g., Goldman Sachs, JPMorgan Chase) offers valuable context and enables a comparative analysis of BlackRock's compensation practices within the broader competitive landscape.

- SEC Filings: BlackRock's public filings (10-K reports) with the Securities and Exchange Commission 1 reveal information on overall compensation trends, albeit not VP-specific data. This information provides crucial context regarding the overall compensation philosophy and structure at BlackRock. This high-level data helps paint a clearer picture of the organization's approach to compensation.

By triangulating data from these various sources, we can construct a more reliable and insightful view of BlackRock VP compensation. This multi-pronged strategy significantly enhances the accuracy and robustness of our analysis. How can further refining our methodology improve this picture even more?

Key Factors Influencing BlackRock VP Salaries

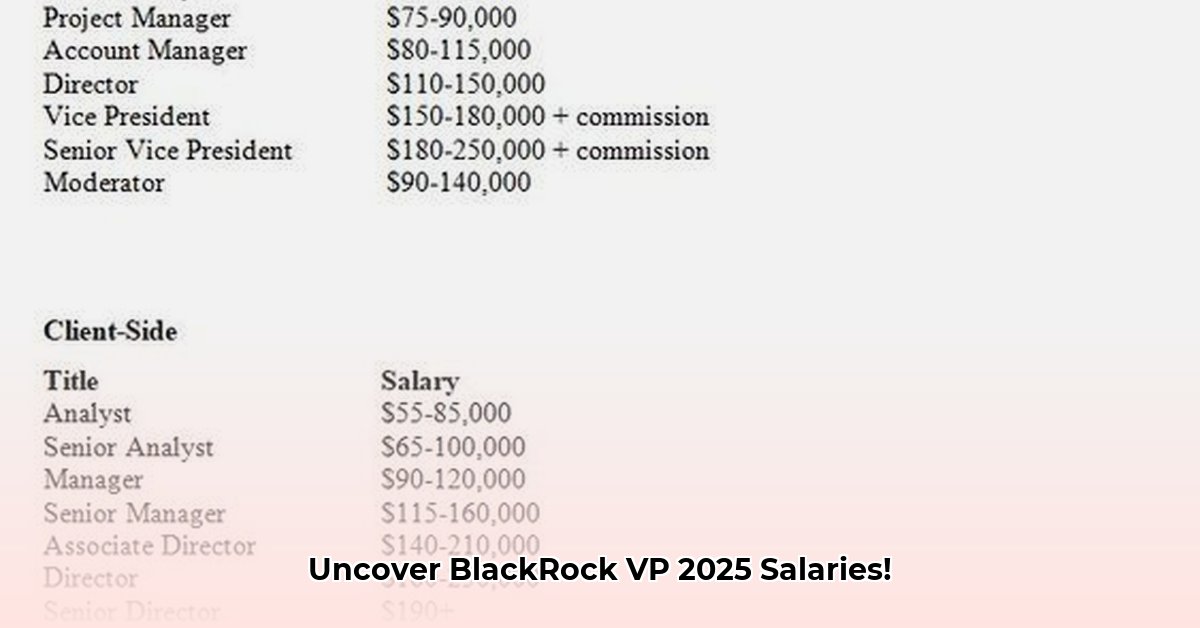

Several factors interact to influence the substantial variation in BlackRock VP salaries:

- Base Salary: While a relatively consistent starting point (approximately $160,000), base salaries may vary based on experience and specific responsibilities.

- Performance-Based Bonuses: A significant portion of total compensation, often representing a substantial increase over base salary and significantly impacting the overall compensation package. These bonuses are directly tied to individual and firm performance, creating considerable variability.

- Stock Options and Equity: These provide additional compensation tied to BlackRock's overall performance, further enhancing the unpredictability of the total compensation package.

- Experience Level: Senior VPs will naturally command higher salaries compared to those with less experience.

- Department: VPs in high-demand areas such as investment management may earn more than those in less specialized roles.

- Location: Geographic location significantly impacts cost of living, which can influence overall compensation.

Understanding these interwoven factors is crucial for accurately understanding BlackRock's VP compensation landscape. How do we mitigate the risks associated with using incomplete or biased data?

Risk Assessment: Navigating the Data Challenges

Analyzing salary data, particularly from multiple, disparate sources, carries inherent risks. The following risk assessment matrix illustrates potential challenges and mitigation strategies:

| Risk Factor | Probability | Impact | Mitigation Strategy |

|---|---|---|---|

| Sample Size Bias | Medium | Medium | Utilize multiple large-sample data sources, including multiple compensation surveys. |

| Data Accuracy | Medium | High | Cross-reference data from multiple independent sources. |

| Outdated Information | High | Low | Regularly update data using the latest available information from all resources. |

| Job Function Variations | High | Medium | Segment data by job function and experience level to identify nuanced variations. |

| Reporting Bias | Medium | Medium | Triangulate data from various sources to neutralize biases. |

Conclusion: A Holistic Perspective on BlackRock VP Compensation

Accurately determining a BlackRock VP's salary demands a comprehensive approach that moves beyond single data points. By integrating data from multiple sources (Glassdoor, compensation surveys, competitor analysis, and SEC filings), while acknowledging inherent limitations and biases, we can build a far more accurate and nuanced understanding of the complex factors that shape compensation at this leading financial institution. While a single definitive number remains elusive, a holistic approach allows for a much more informed and reliable assessment.